Development of the 2024 national model energy code is well underway, and the process for this cycle differs significantly from previous cycles.

The International Code Council (ICC) oversees the development of building codes that regulate how buildings are constructed, including the International Energy Conservation Code (IECC).

In years past, the energy code was developed through a process in which the final decisions were determined by the votes of government officials.

Beginning with the development of the 2024 IECC, the ICC board of directors changed the procedure so it now follows a standards development process where final decisions rest with consensus committee members who represent a wide range of stakeholders.

RELATED

Code-change proposals were submitted in the fall of 2021, with more than 200 proposed changes to the residential energy code and more than 250 proposed changes to the commercial energy code.

National Association of Home Builders (NAHB) members and staff have been on these committees in recent months and in various residential and commercial subcommittees and working groups. NAHB seeks to make sure the next iteration of the model energy code is grounded in cost-effective, practical solutions that work in the field and are acceptable to homebuyers and homeowners.

The 2024 IECC will be more stringent than the 2021 IECC in terms of overall energy performance.

The ICC board gave the committee this directive: “The code is updated on a three-year cycle with each subsequent edition providing increased energy savings over the prior edition.” The ICC Board also added that changes must be “technologically feasible, and life cycle cost effective, considering economic feasibility, including potential costs and savings for consumers and building owners, and return on investment.”

Key Proposals Under Consideration for Changes to the 2024 International Energy Conservation Code

The 2024 IECC will be more stringent than the 2021 IECC in terms of overall energy performance. Significant proposals under consideration include:

• Requiring whole-home electrification or ensuring the home is electrification-ready

• Requiring on-site solar panels

• Requiring homes to be solar-ready and energy-storage-ready

• Requiring electric vehicle charging capability or readiness

• Requiring grid-interactive equipment for demand response

• Increasing the stringency of insulation, windows, and building and duct tightness

• Requiring energy-recovery ventilators (ERVs)

• Eliminating the batt insulation option at rim joists

• Requiring third-party inspections for energy code compliance (instead of inspection by building inspectors)

• Requiring air handlers to be located in conditioned space

• Requiring ASHRAE 62.2 ventilation rates (much higher rates)

• Requiring increased building tightness

• Further reducing overall flexibility (for example, removing air tightness trade-offs)

• Imposing a penalty on houses larger than 5,000 square feet

• Realigning energy efficiency measures to prioritize more cost-effective strategies

• Improving flexibility and increasing choices for achieving compliance when using performance design

Many of these provisions, if approved into the 2024 code, could significantly affect home design and construction costs and limit a builder’s flexibility to optimize building performance.

In the coming months, NAHB members must become engaged in this process and raise and voice their concerns. Visit nahb.org/2024IECC to learn more.

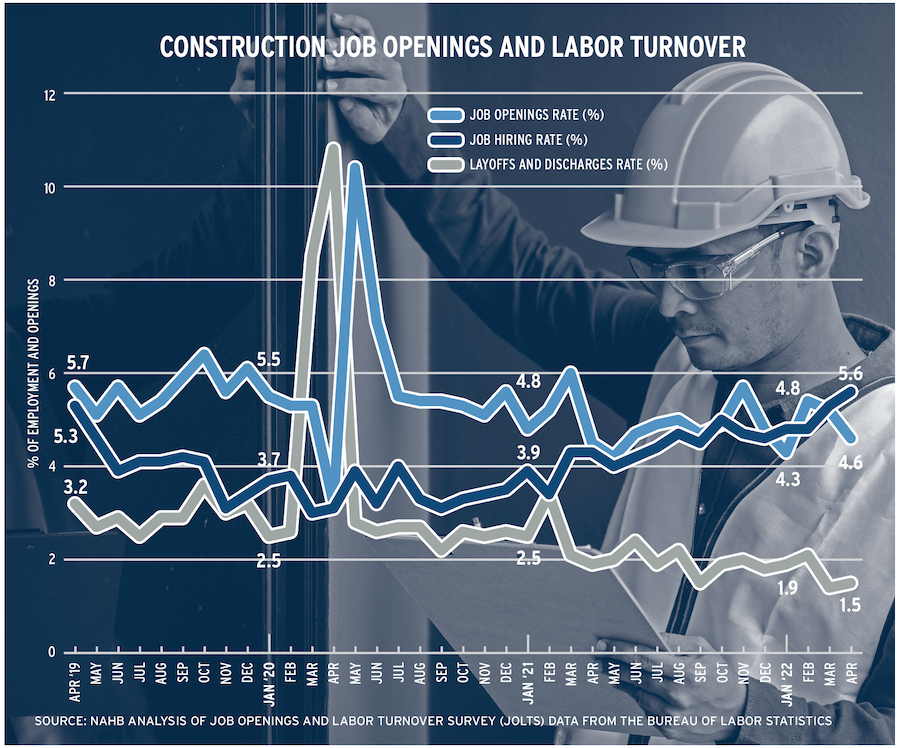

Construction Job Openings Reach Record High

The construction labor market is tight, with the count of open construction jobs jumping to 449,000 unfilled positions in April. This is significantly higher than the 329,000 unfilled positions recorded a year ago and is the highest measure in the history of the data series, which goes back to 2000.

The housing market remains underbuilt and requires additional labor and buildable lots, as well as a reliable supply of lumber and other building materials. But there are signs that the market is slowing in response to rising interest rates. Hiring in the construction sector ticked down to a rate of 4.6%. The post-virus peak rate of hiring occurred in May 2020 (10.4%, as seen in the chart, below) as a rebound took hold in home building and remodeling.

Attracting skilled labor will remain a concern for construction firms in the coming years. And although a slowing housing market may take some pressure off tight labor markets in the short term, the long-term labor challenge will persist beyond upcoming business cycle events.

Responses