Lessons From the First to Summit Mt. Everest

Edmund Hillary once remarked that he was unsure if summiting Mt. Everest was within the realm of “humanly possible.” Nonetheless, he and his Nepalese climbing partner, Tenzing Norgay, left the first confirmed pair of human footprints on the summit of Mt. Everest in May of 1953. Hillary’s doubt surely stemmed from the failed previous attempts to summit the highest peak on earth (last recorded in 2020 as 29,031.7 feet above sea level).

Following the mountaineers’ extraordinary triumph of human endurance and determination, Hillary and Norgay exclaimed appreciation for a well-planned, thoroughly prepared, and strongly led team effort. Despite the fame and stature of the first humans to reach its peak, the two people that took those treacherous steps high atop the world were team players in the strictest sense. They also left us with a heightened value of planning and understanding our surroundings to get the results we seek.

The highest peak in the world was identified sometime in the 1850s, and it took around a century to reach its famed crest. Before the 1953 expedition that claimed the first confirmed summit by Hillary and Norgay, men had vanished, been brutally injured, and failed to summit the peak even with the vast sums of capital, both human and monetary, and ambitious government backing. Getting to the top of Everest was and is a formidable feat to accomplish.

The victorious climbers and their teams in 1953 distinguished themselves in many ways. These ideas render well into sage advice for building product manufacturers seeking to conquer summits of their own.

How can the summitting of the world’s highest mountain nearly seven decades ago help building product manufacturers better achieve their objectives? Here we explore the value of understanding market share and its benefits to manufacturers seeking to claim their victories.

What is Market Share

Market share is a simple concept that is reported in various ways. For building product manufacturers, there is value in determining and understanding insights from absolute and relative market share. Expressed as a portion of the total dollar revenue or as a percentage of the total market volume for a product or category of products, generations of business leaders have relied on these absolute market share figures to help direct and propel sales and revenue growth strategies. For instance, consider a company that sells windows. If 3,800 windows are sold by a company, and 117,000 windows are sold in the country over 12-months, the market share is 3.24 percent of all windows sold.

Market share is also viewed from a competitive landscape perspective. This approach aggregates a group of competitors and provides percentages of the sales or revenue in a category or segment. Consider the window company again. They sell 3,800 windows. In the windows category, assume three competitors sell 12,132 windows a year. With 3,800 units sold a year, the company has a 31% market share of all windows sold. This figure is the relative market share comparison which can provide advantageous insights for building product manufacturers (see below).

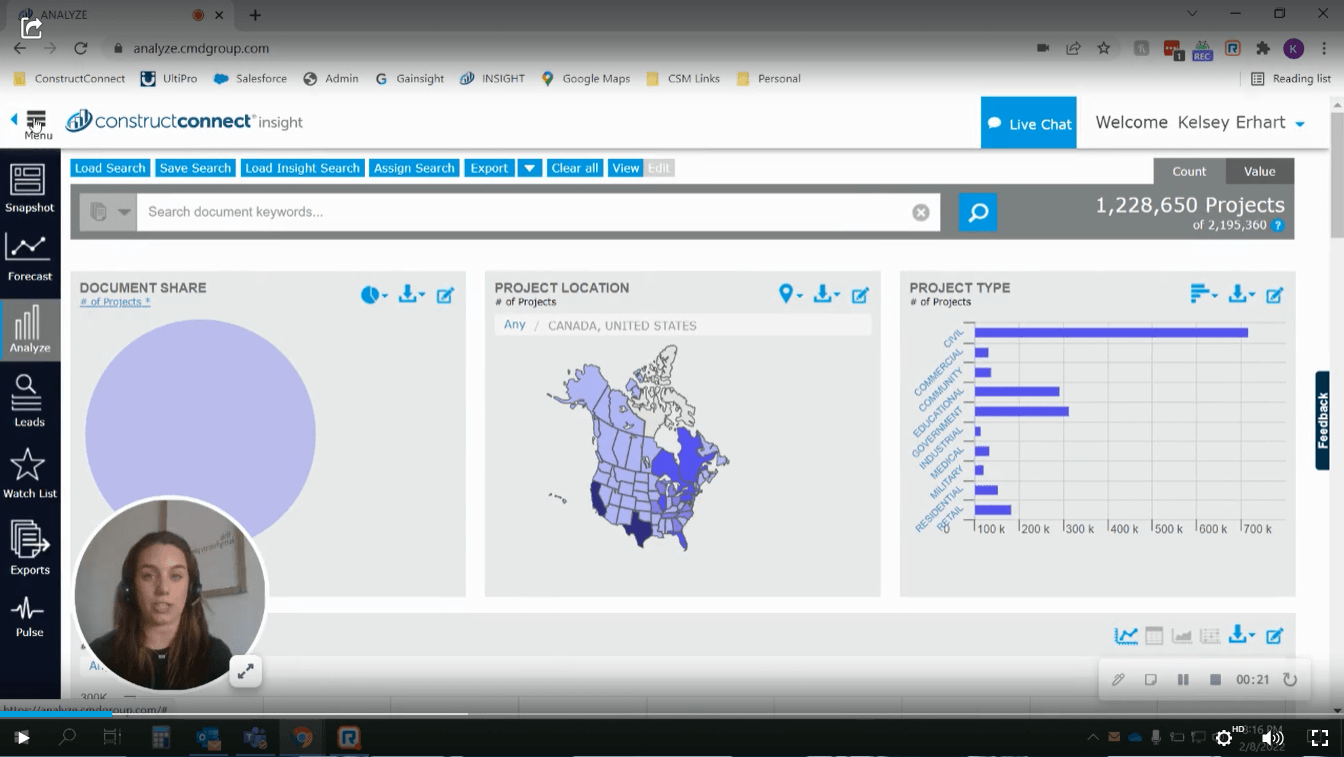

Watch this video on how ConstructConnect Insight delivers market share data with just a few clicks of your mouse.

The Value of Knowing Your Market Share

The enormous body of data in the realm of building product manufacturers continues to grow in size and complexity. Harnessing this data and turning it into usable insights, combined with what companies already know, is essential to thriving in our competitive landscape.

Data is only as good as the insights it produces. Market share data reveals significant opportunities for the building product manufacturer through market intelligence. Since market share is closely tied to profitability, market share objectives are commonly part of C-suite conversations and strategies. The established relationship between market share and profitability differs among industries, but market share demonstrably affects purchasing, hiring, and marketing decisions. With this much emphasis on the value of knowing your market share, what lessons did Hillary and Norgay leave building product manufacturers?

Lessons From Everest

Know Your Surroundings

Survival in any environment requires at least a fundamental know-how of the landscape. Whether it is a trek through the woods, a weekend journey to a neighboring town, or a voyage across the Atlantic. To thrive, though, when the consequences are high and competition fierce, one must become much more familiar with your surroundings.

In the realm of building product manufacturers, a profound awareness of the competitive environment forms the bedrock of successful strategy implementation. Market share is one measure that reveals the competitive environment and adds to existing strategic knowledge. The result of such knowledge can expose opportunities for new sales, provide a basis to adjust resource allocation, and respond to changes in the market.

With the help of their planning and support team, Hillary and Norgay were acutely aware of their environment and understood the conditions they needed to summit Everest successfully. Besides favorable weather, they also required shelter, oxygen, and food. Think about digging deep into your market share and what a keen grasp on your surroundings can do for meeting strategic objectives.

Have a Route

Perhaps the most enduring legacy of pioneering climbers Hillary and Norgay is their route to the world’s highest point in 1953. At the time, reaching the summit was as questionable as “flying machines” once were, which we now know as airplanes. But the first two humans to step upon the peak of Everest demonstrated it was indeed possible, and since then, over 10,500 others have reached the summit. Besides showing it was possible, Hillary and Norgay had thought about and mapped a route, using resources and knowledge about the environment they faced.

A sales strategy that allocates scarce resources such as people, selling efforts, and money can be optimized by planning a route. How can a strategic route be planned for building product manufacturers to grow sales? Market share data is quickly produced with a few clicks of the mouse with the Analyze module on the ConstructConnect Insight. You can reveal architects, engineers, general contractors, building owners, projects, and segments—and prioritize and target them precisely.

Start by running a market share analysis of your company. With just a few more mouse clicks, you can dig into new opportunities for commercial building design and construction projects by CSI code, project type, state, or region to target new sales opportunities. Whether your objective is to achieve market penetration, boost gross sales, or optimize resources, market share data can help identify a route to reaching new heights.

Adapt to Conditions

Leaders of the 1953 expedition engaged in a tactic that successful climbers on Everest still use today. They had learned from those that came before them and failed. They picked apart reports filled with data on nutrition, acclimatizing to the altitude, and equipment. And they adapted their resources to meet the conditions face-to-face.

To thrive in a dynamic market, building product manufacturers also need to adapt. Market share data shows where products are specified and by which companies (e.g., architects, engineers, and building owners) provide opportunities to capture changing market conditions and seize shifting trends. Combined with knowledge from within the manufacturer and the desire to delight customers, higher market share, profits, and sales are possible.

Building product manufacturers can quickly get market share data with the Analyze module on ConstructConnect Insight. And can develop actionable insights and trend analyses to understand past performance, where to deploy your sales teams, and who to target to increase your specification rate.

Adapting with market share intelligence is also beneficial to demand planning, collaboration with distributors, scheduling, and inventory control.

With insights from market share data and an awareness of market changes, building product manufacturers can embrace change instead of being threatened by it.

Claim the Mountaintops

For Edmund Hillary and Tenzing Norgay, the claim of being first to summit Everest changed the trajectory of their lives at once. The Times of London broke the story June 2, 1953, with the headline “Everest Conquered,” as if a fire-breathing beast was duly slain. In fact, it had been a remarkable achievement for humankind. Generations of doubt and setbacks about the limits of our exploration and discovery were eclipsed by two ordinary citizens of the world who had the resources and determination to keep climbing upward.

Indeed, a victory for humankind as the intrepid explorers left behind more than tales of experience. They blazed a trail with perspective, organization, and information. On this track, building product manufacturers may claim the unconquered but conquerable mountaintops of their own.

Stay tuned to this blog as we continue to explore what an information advantage can do for building product manufacturers and how to stay on track with the challenges of today’s supply chain.

The Analyze module on ConstructConnect Insight delivers actionable, data-driven market insights. You can evaluate current market opportunities and threats, align resources and systems with growth opportunities, visualize gaps in your market, and build a roadmap for strategic growth.

Responses