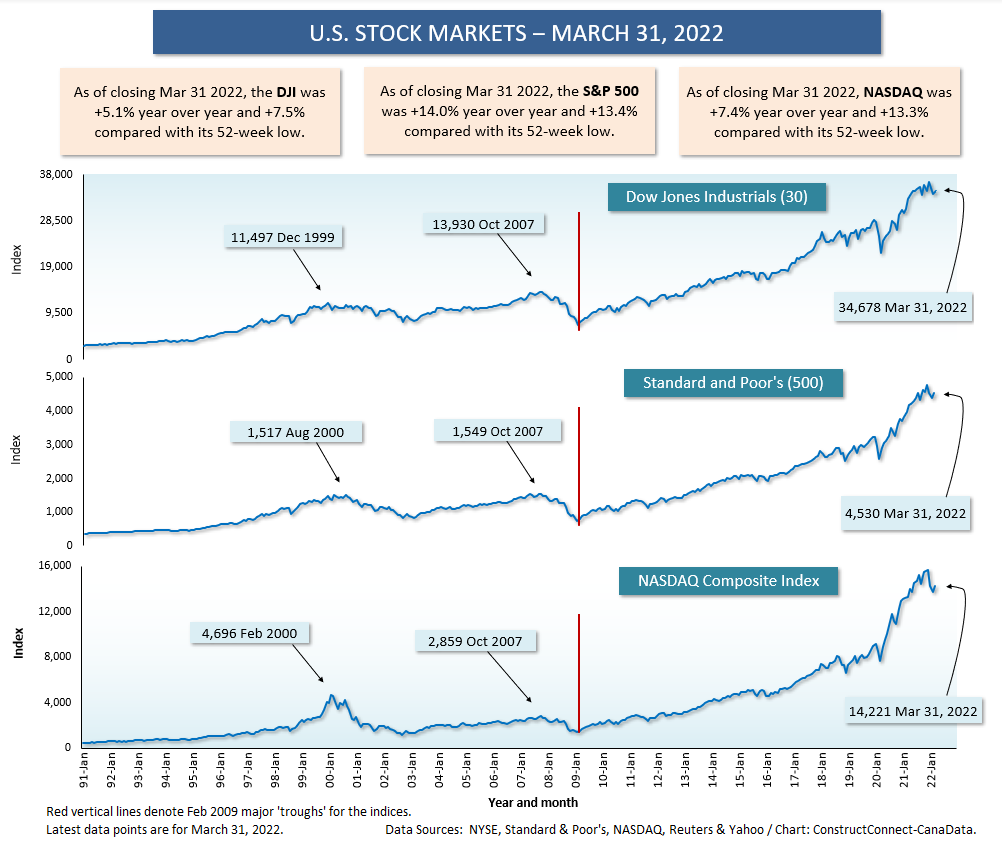

The three main U.S. stock market indices turned positive again during March, after dipping and diving through January and February.

The DJI from the beginning to the end of March was +2.3% after being -3.5% in February and -3.3% in January.

The S&P 500 was +3.6% in March after being -3.1% in February and -5.2% in January.

NASDAQ was +3.4% in the latest month after being -3.4% in February and -9.0% in January. (It should be noted that NASDAQ was in bear territory not so long ago. From November 22, 2021, to March 14, 2022, NASDAQ’s high-to-low index level descent was -22.6%.)

Toronto’s stock exchange has performed better than the American indices, +3.6% in March, after being flat in February, at +0.1%, and down only a little in January, -0.6%. The TSE, or TSX as it is alternatively known, is heavily weighted with resource sector firms. Most commodity prices were firming up before Russia’s invasion of Ukraine, and the new geopolitical uncertainty has magnified the tendency for investors to want to hold physical assets, such as gold.

By the way, surges in commodity prices have historically been positive for the development and construction of mega-sized resource projects.

On a year-over-year basis, the TSX currently has the best record for share price increase in the world, +17.1%, leading the S&P 500, at 14.0%; the iShares pre-emerging markets ETF index, +12.6%; and London’s FTSE, +11.9%.

On the flip side, China’s indices have been faring poorly. In March, on a y/y basis, Hong Kong’s Hang Seng index registered the steepest decline among the 14 indices shown in Table 2 and Graph 4, -22.5%; and in the latest month, the Shanghai Composite index was the weakest month to month, -6.1%.

Financial woes in the Chinese real estate sector have spread beyond Evergrande to other firms including Kaiso and Shimao. Defaults on debt repayments are being monitored and broadcast by international rating agencies.

The Chinese economy is also expected to suffer a setback from the commodity price advances. China’s economic growth model still depends, to a significant degree, on strong exports of manufactured goods. Implied in that dynamic, however, is a continuing heavy reliance on imported resource sector inputs such as iron and coal for steelmaking.

Speaking of debt problems, the Russian government is believed to be in danger of not being able to meet its rollover payments. This difficulty also extends to some big Russian firms with dollar-denominated carrying-cost obligations

The first round of severe financial and trade sanctions on Moscow forced the closing of Russia’s stock market. After a time-out lasting about a month, it has been partially reopened.

The highest-profile rating agencies, however, are now taking a pass on publishing their assessments of the financial viability of some of Russia’s biggest corporate entities, making it harder for them to raise investment capital.

Approaches to the Supply Crisis

The big concern for investors in stock market shares is central bank moves to raise interest rates.

Rate hikes, in turn, are being compelled by rapid inflation. A significant portion of the head-banging price inflation currently underway derives from supply shortages.

What are some answers to the supply crisis? The following is a list of admittedly generic solutions and readers have probably thought of most of these themselves. Nevertheless, it’s worth recording them for reference.

- Step away, somewhat, from just-in-time inventory, favoring instead more stockpiling of key components. This will further the move toward warehouse construction.

- Consider requesting early commitment to proceed letters from owners about to undertake construction projects to facilitate placing advance orders from suppliers.

- Research potential usage and availability of substitute material inputs.

- Where possible, cultivate alternative sources. This may include the pursuit of joint ventures. Two firms may have component excesses and deficiencies that counterbalance one another.

- Accept that you must pay more for some items while looking in other directions for cost-cutting opportunities. Possibilities include:

- A restructuring of lines of credit to reduce interest payments.

- Embracing software solutions in key operational areas such as scheduling.

- Choosing alternative shipping routes or modes of transportation (i.e., between sea, air, railroads, and trucking).

- Explore greater usage of automation and the modular approach.

- Turn ever more towards high tech. For example, in any template work (forestry product inputs and structural steel), laser-guided precision cutting will reduce waste. Less waste stretches the usefulness of what is at hand.

Table 1

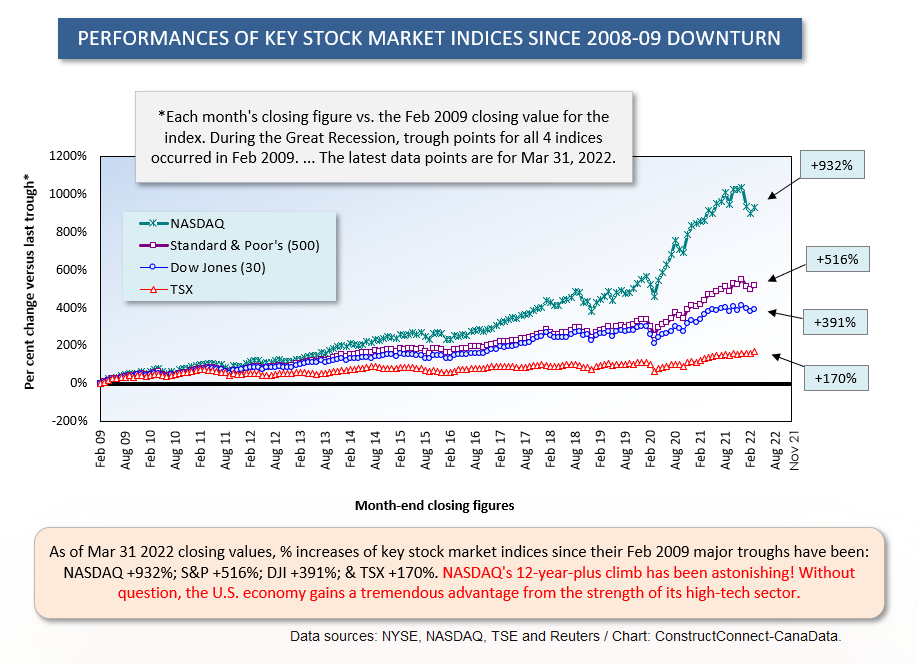

Graph 1

Graph 2

Graph 3

Table 2

Graph 4

Responses