Clichés are often true and it is the case that a picture can be worth a thousand words.

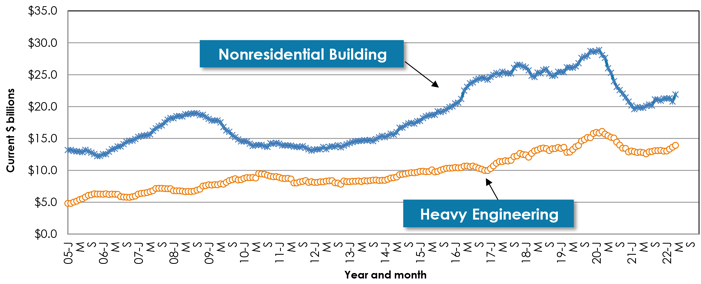

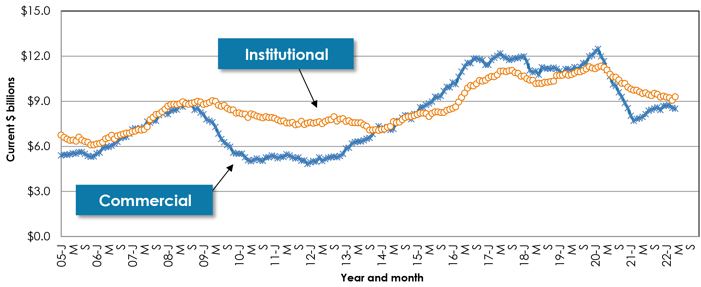

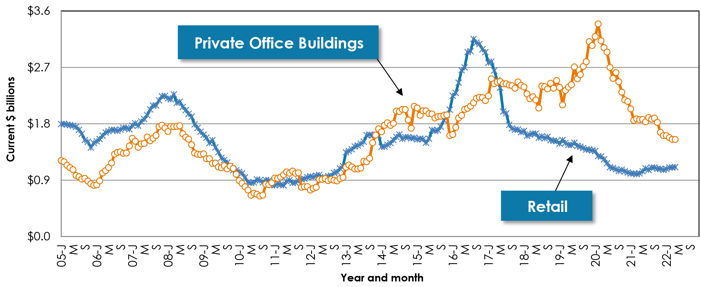

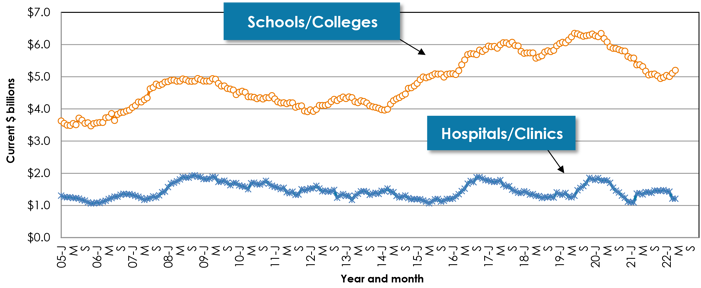

Below are six graphs recording 12-month moving averages of ConstructConnect’s nonresidential construction starts.

When the value of the current month is higher than for the same month a year ago, the line will turn up; when lower, it will dip.

String a couple of similar positive or negative directional changes together over several months and one has a trend.

And that’s what the graphs are designed to do, show improving or deteriorating trends in a dozen major and more granular categories of construction work.

Click here to download the Construction Industry Snapshot Package – April 2022 PDF.

Click here for the February 2022 Industry Snapshot article, April’s Nonresidential Construction Starts +51% M/M, +45% Y/Y, & +14% YTD.

Click here for the Top 10 Project Starts in the U.S. – April 2022.

Graph 1: U.S. Nonresidential Construction Starts ‒ ConstructConnect

(12-month moving averages)

Source and Chart: ConstructConnect.

Graph 2: U.S. Commercial & Institutional Construction Starts ‒ ConstructConnect

(12-month moving averages)

Source and Chart: ConstructConnect.

Graph 3: U.S. Retail & Private Office Building Construction Starts ‒ ConstructConnect

(12-month moving averages)

Source and Chart: ConstructConnect.

Graph 4: U.S. Hospital/Clinic & School/College Construction Starts ‒ ConstructConnect

(12-month moving averages)

Source and Chart: ConstructConnect.

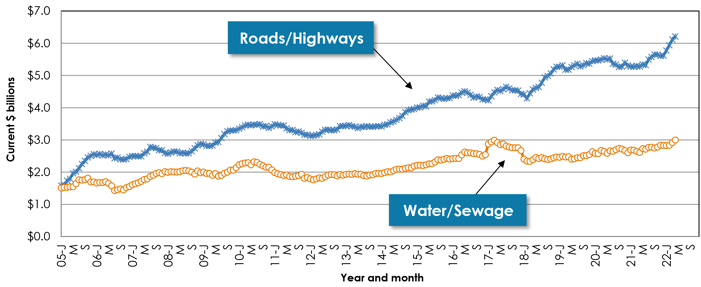

Graph 5: U.S. Road/Highway & Water/Sewage Construction Starts ‒ ConstructConnect

(12-month moving averages)

Source and Chart: ConstructConnect.

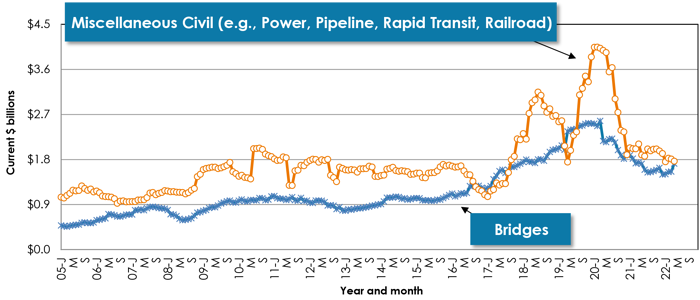

Graph 6: U.S. Bridges & Miscellaneous Civil Construction Starts ‒ ConstructConnect

(12-month moving averages)

The last data points in all the graphs on this page are for March 2022.

Source and Chart: ConstructConnect.

Responses