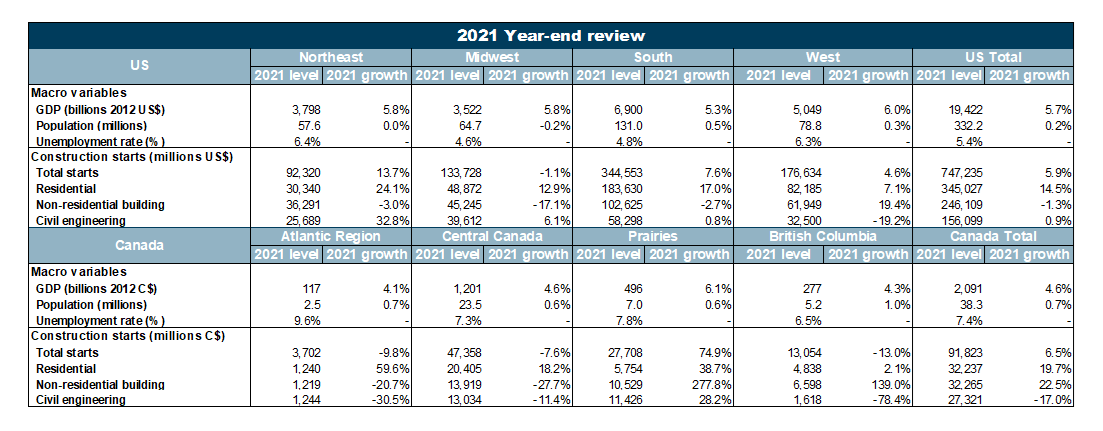

U.S. construction starts grew 5.9% in 2021 to $747 billion, with divergent outcomes across the three headline sectors. New residential construction grew 14.5%, with growth in both the single-family and multi-family segments. Nonresidential building, by contrast, declined 1.3% with significant pandemic-related scarring persisting in sectors related to travel and office working. Civil engineering construction was broadly flat, posting growth of just 0.9%.

On a regional basis, the Northeast experienced the strongest growth in 2021, although it also posted the biggest decline in the prior year and is still in the biggest hole relative to 2019 compared to other regions.

Canadian construction starts grew 6.5% in 2021 to C$91.8 billion. Residential construction grew 19.7%, with rises in both the residential and nonresidential sectors. Nonresidential building grew 22.5%, largely driven by ground-breaking on a C$7.5 billion potash mine in Saskatchewan towards the end of the year. By contrast, civil engineering construction fell 17%, with a particularly steep decline posted in the miscellaneous civil sector.

United States Year in Review

The U.S. economy rebounded swiftly from the coronavirus pandemic, growing 5.7% in 2021, the fastest pace since 1984. By Q2 2021, the economy had returned to its pre-pandemic level, and by Q2 2022, it is forecast to exceed the level we were projecting in January 2020. The recovery has been uneven, with a strong rebound in goods-producing sectors, but high-contact services still below pre-pandemic levels. Fiscal stimulus measures, including direct payments to households, helped prop up household incomes and led to record levels of household savings. However, strong demand for goods resulted in bottlenecks in global supply chains and rising prices. Inflation rose to nearly a 40-year high of 7% in December.

An accommodative monetary policy stance since the onset of the pandemic has pushed up both economic activity and inflation, but the Fed is widely expected to start applying the brakes in early 2022. The labor market also rebounded through the course of 2021. By the end of the year, the economy had recouped about 85% of jobs lost during the pandemic, and the unemployment rate sat at 3.9%. However, labor force participation has yet to recover to its pre-pandemic level, and job openings have jumped to record highs.

As elsewhere in the economy, the construction sector has faced labor shortages and soaring prices for raw materials. Lumber price inflation surged to a triple-digit rate in the spring, although prices have eased back since then. But soaring metals prices later in the year have more than offset this, and as a result, construction materials inflation rose to 22% in December, the fastest pace in nearly 50 years. On the labor side, construction job openings jumped to a record high in October, and although it eased back in November and December, it remained at a high level. Wage growth in the construction sector has also started to pick up, with weekly earnings up nearly 5% year-on-year in December.

New construction starts grew 5.9% in 2021, with divergent outcomes across the three headline sectors of residential building, nonresidential building, and civil engineering. New residential construction posted the strongest growth, up 14.5%, with growth in both the single-family and multi-family segments. The shift to home working during the pandemic boosted demand for more space and away-from-city living, favoring single-family construction.

New single-family homebuilding increased 16.9% last year. New apartment construction increased at a slower pace of 8.1%, but as workers start to return to the office, demand for apartments is likely to rise again, especially in the younger millennials and Gen Z groupings. The multi-family segment is expected to outpace the single-family segment this year.

Nonresidential building, by contrast, declined 1.3% in 2021 and is now 28% below its level in 2019. The level of scarring is even greater in projects related to travel or office working. This is especially the case in the construction of new hotels, which was 72% below its 2019 level in 2021. Private office building was more than 50% below its level of activity in 2019, and construction starts on new parking garages, religious centers, sports arenas & convention centers, and factories were more than 40% below 2019 levels.

However, there are potentially other dynamics in play with factory construction. Construction activity in the sector was at a record high in 2019, having grown 55% that year, and annual growth is particularly affected by the inclusion or absence of megaprojects. Although still significantly below levels in 2019, ground-breaking on several large industrial projects began in 2021, underpinning full-year growth of 41.7%. These include an $8 billion Intel plant in Arizona, a $2 billion GM factory in Texas, a $1.3 billion plastics factory, and a $1.3 billion methanol plant, both in Louisiana.

Other sectors to see strong growth in 2021 included transportation terminals, which grew 294%. This was driven by two large expansions at airport terminals: a $1.4 billion project in Pittsburgh and a $3.4 billion project in San Diego. Construction of new hospitals increased 24.3% in 2021, underpinned by three large projects: two in California and one in Ohio.

New engineering starts were broadly flat in 2021, posting growth of 0.9%. Within this overarching category, construction of airports, bridges, and miscellaneous civil (including oil & gas projects, tunnels, and railway projects among other things) all declined at a double-digit rate. Construction of dams, canals, and marine work; water, sewage, and treatment; and roads all grew at a single-digit pace. Construction of new power projects was the biggest winner in 2021, growing 92%. The sector had declined 69% in 2020, so it remains 40% below its pre-pandemic peak, but there were also showcase large projects, most notably a $2.8 billion offshore wind farm in Massachusetts. Given the sector’s importance in the green transition, we expect to see construction rise above its previous peak by next year.

On a regional basis, all the major regions except the Midwest grew in 2021. The Northeast experienced the fastest pace of growth, increasing 13.7%. However, the region also posted the biggest decline in 2020, and is therefore in the biggest hole relatively to 2019. The Northeast experienced strong growth in residential construction, underpinned by the factors driving single-family homebuilding nationally. The multi-family segment was also solid due to ground being broken on a $1.5 billion apartment project in New York in February. Regional engineering starts were also robust with large power projects in Maine and Massachusetts supporting sector activity.

Construction in the South and West grew by a more subdued 7.6% and 4.6% respectively. Residential construction increased in both regions, and the other two sectors displayed mixed outturns. Nonresidential construction in the West, where the $8 billion Intel factory is classified, grew by 19.4%, but new engineering projects fell 19.2%. In the South, nonresidential building fell 2.7% and engineering starts increased 0.8%.

Construction in the Midwest contracted 1.1%, with increases in homebuilding and civil engineering more than offset by a large decline in nonresidential building.

Canada Year in Review

Canadian GDP is estimated to have grown 4.6% in 2021 with data through Q3. GDP growth was patchy throughout the year, as measures to contain the virus and subsequent reopening of the economy led to swings in quarterly growth. The economy largely shrugged off last winter’s wave, with GDP continuing to expand 1.2% quarter-on-quarter (q/q) in Q1 2021, but a third wave in the spring and the reintroduction of lockdown measures led to a 0.8% q/q contraction in Q2 2021.

Steady growth returned in the second half of the year with the full reopening of the economy in the summer, but global supply chain and weather-related disruptions contained the pace of growth to 1.3% q/q in both Q3 and Q4. Measures to contain the Omicron wave in early-2022, on top of existing supply chain disruptions, could see a further slowdown in economic activity in the near term. Persistent supply chain issues and rising commodity prices pushed inflation to a 30-year high of 4.8% in December, and like in the United States, we expect the Bank of Canada to begin raising interest rates in the spring. The labor market ended 2021 on an upswing with the unemployment rate now at 5.9%, the lowest level since the pandemic began.

Canadian construction starts grew 6.5% in 2021, driven by a 19.7% increase in residential and a 22.5% rise in nonresidential building, but countered by a 17% contraction in civil engineering. In the residential sector, both single-family and multi-family construction starts increased, by 34.3% and 5.4% respectively. The drivers in the initial strength of the recovery in single-family homebuilding relative to multi-family homebuilding were similar to those in the United States—a shift to home working leading to demand for more space outside of city centers. Restrictions on nonessential construction work in Ontario and Quebec during the first wave of lockdown pushed down the baseline for comparison, but residential construction has also risen above its 2019 level.

The rise in nonresidential building was largely due to a C$7.5 billion potash mine in Saskatchewan, leading to a 332% rise in manufacturing construction. Outside of this sector, amusement & recreation and religious buildings also posted a triple-digit increase in 2021, although in both cases, this was a recovery from a weak base in 2020 rather than the result of megaprojects. The only other nonmanufacturing sectors to increase in 2021 were hospitals & clinics (up 80.8%), police & fire (up 27.6%), and educational facilities (up 17.2%). By contrast, most commercial sectors declined in 2021, with particularly steep contractions in hotels & motels and private office buildings, of 64.1% and 53.5% respectively. New transportation terminals posted the biggest decline last year, down nearly 95%, as a major project in Ottawa in 2020 dropped out of the annual calculation.

New engineering construction declined 17% in 2021, with divergent results across the sectors. Miscellaneous civil projects fell 55.2% in 2021. The sector had one large project this year—a C$2.3 billion pipeline project in Alberta in Q1—but new construction in the sector was extremely weak for the rest of the year. Moreover, sector construction also declined in 2020, meaning new construction activity in 2021 was nearly 70% below its level in 2019. Bridge construction also declined in 2021, by 39.9%, as a project in Surrey, British Columbia in 2020 fell out of the annual calculation. By contrast, water and sewage treatment facilities and power infrastructure both posted growth rates exceeding 40%.

Table 1

Responses