Did Your City Make the Cut?

Amazon has always prized excellence, so it’s no surprise they’re taking their decision for the location of Amazon HQ2 very seriously. Out of 238 initial bids, the e-commerce powerhouse announced its 20 finalists in January 2018 – 19 here in the US and one in Canada. In addition to the basics like a population over 1 million and access to an international airport, Amazon is weighing the following criteria heavily in their HQ2 decision:

- Stable and friendly business environment

- Access to infrastructure and a community

- Ability to produce skilled and technical talent

While several analysts and publications have provided their own top picks for HQ2, we decided to conduct our evaluation to dig into the top construction friendly cities. With Amazon’s criteria in mind, we analyzed the finalists based on buildability. We’ll get into more details about our three-pronged analysis, but first, take a look at our top 10 picks in our SlideShare.

Now, let’s take a look at what criteria Amazon has put forth to make its decision, why it has selected the cities it has and why we think it will soon select one of the top 10 we have identified.

What Amazon HQ2 Means for Construction

In their request for proposal, Amazon outlined several characteristics of cities they would consider for HQ2. They conveyed a strong preference for cities with stable and business-friendly environments likely to encourage fast growth and attract and retain strong technical talent. They also hope to settle in a community that thinks “big and creatively when considering locations and real estate options.”

As the company’s website explained, this is not a decision they take lightly. Their first headquarters, located in Seattle, added an estimated $38 billion to the city’s economy between 2010 and 2016, adding $1.4 to Seattle’s financial infrastructure for every dollar spent by Amazon.

“Amazon HQ2 will be Amazon’s second headquarters in North America,” the company explains, adding that their expected construction investment will clock in somewhere around $5 billion.

The company hopes Amazon HQ2 will land downtown or in an urban area, with enough space to accommodate a campus similar to the one in Seattle. They would also like a site already prepped for development and don’t want to wait for their chosen city to do the prepping, for timeline reasons.

Their goal is to “grow this second headquarters to include as many as 50,000 high-paying jobs – it will be a full equal to our current campus in Seattle. In addition to Amazon’s direct hiring and investment, construction and ongoing operation of Amazon HQ2 is expected to create tens of thousands of additional jobs and tens of billions of dollars in additional investment in the surrounding community.”

The city and metro area that wins the bid will experience not only construction growth directly from the headquarters, but due to the investment in jobs, community and real estate, the building sector will flourish from new investments.

The Amazon HQ2 Decision Through the Lens of Construction

For our evaluation, we put a construction spin on Amazon’s criteria. They include:

- Criteria 1: Stable and Business Friendly

- Criteria 2: Real Estate, Infrastructure and Community

- Criteria 3: Retain and Attract Talent

The evaluation included compiled data from American General Contractors (AGC), CNBC’s Top States for Business 2018, WalletHub and Housing News Report.

Our evaluation excluded DC and Toronto for lack of an apples-to-apples assessment from our state and country research. We also believe that Montgomery County and Northern Virginia already represented DC.

Note: All rankings are provided in numerical order of “1” being the strongest and “18” being the weakest in each subcategory. If two cities or metro areas fell the same in the rankings, they were each given the same number that they fell in the sequence.

Criteria 1: Stable and Business Friendly

A stable and friendly business environment will help ensure the long-term success of Amazon’s investment in HQ2. When a local economy is thriving, it’s more likely to attract serious construction investment. Furthermore, a healthy business environment where investments are steadily coming in means less for construction risk for projects.

In our evaluation, we determined the following criteria was essential for both a business and construction friendly environment:

- Business-friendly (by state)

- Cost of doing business (by state)

- Economy (city)

- Economy (state)

Here’s how our cities ranked in each sub-criteria:

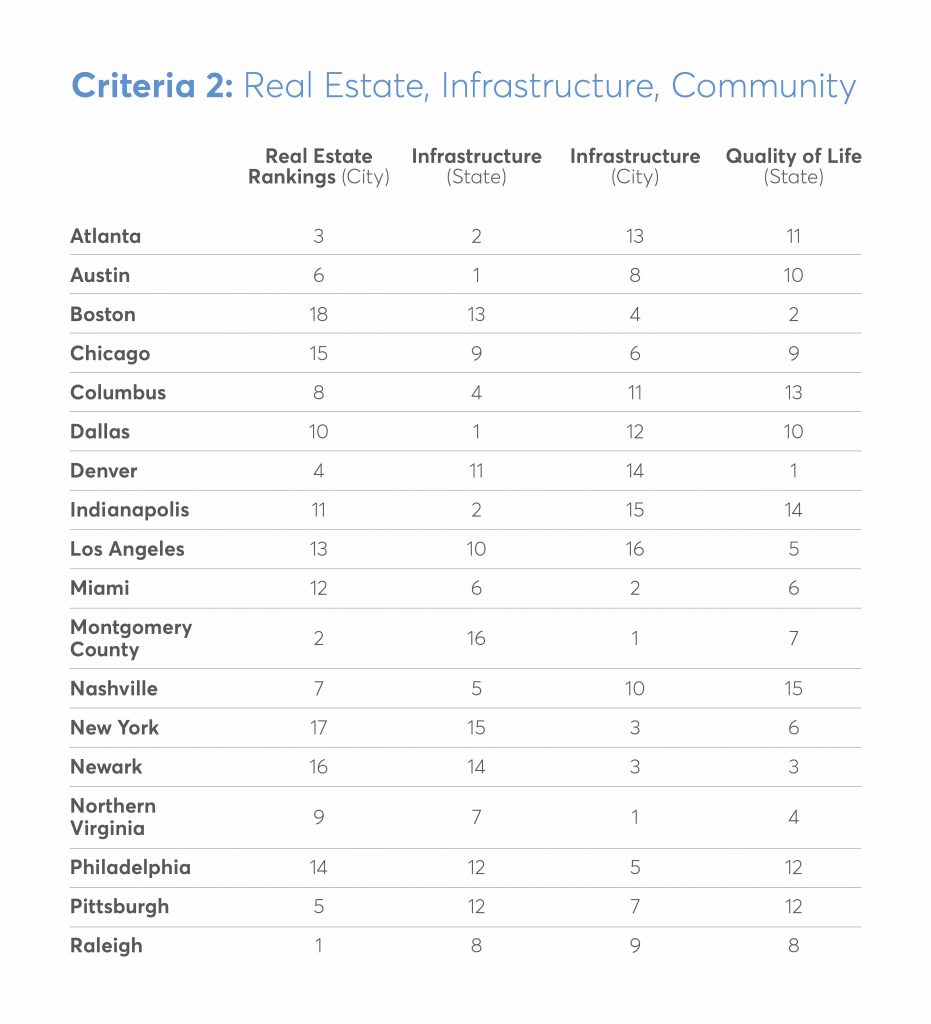

Criteria 2: Real Estate, Infrastructure and Community

America, in general, has poor infrastructure, rated a lowly D+ on the 2017 Infrastructure Report Card. The lack of infrastructure in many regions throughout the country tightens the pool of candidates considerably. Cities and metro areas with better infrastructure will not only allow teams to build faster, but it helps support Amazon’s efforts long-term in the area.

Furthermore, the surrounding community is also an essential component of the Amazon HQ2 decision. A thriving community means the population is more likely to invest in the area in the long-term–beneficial for both Amazon’s future workforce and construction growth in the future.

We evaluated the following to determine how each city ranks on real estate, infrastructure and community:

- Real estate rankings (city)

- Infrastructure (state)

- Infrastructure (city)

- Quality of life (state)

Here’s how the finalists fell in the rankings:

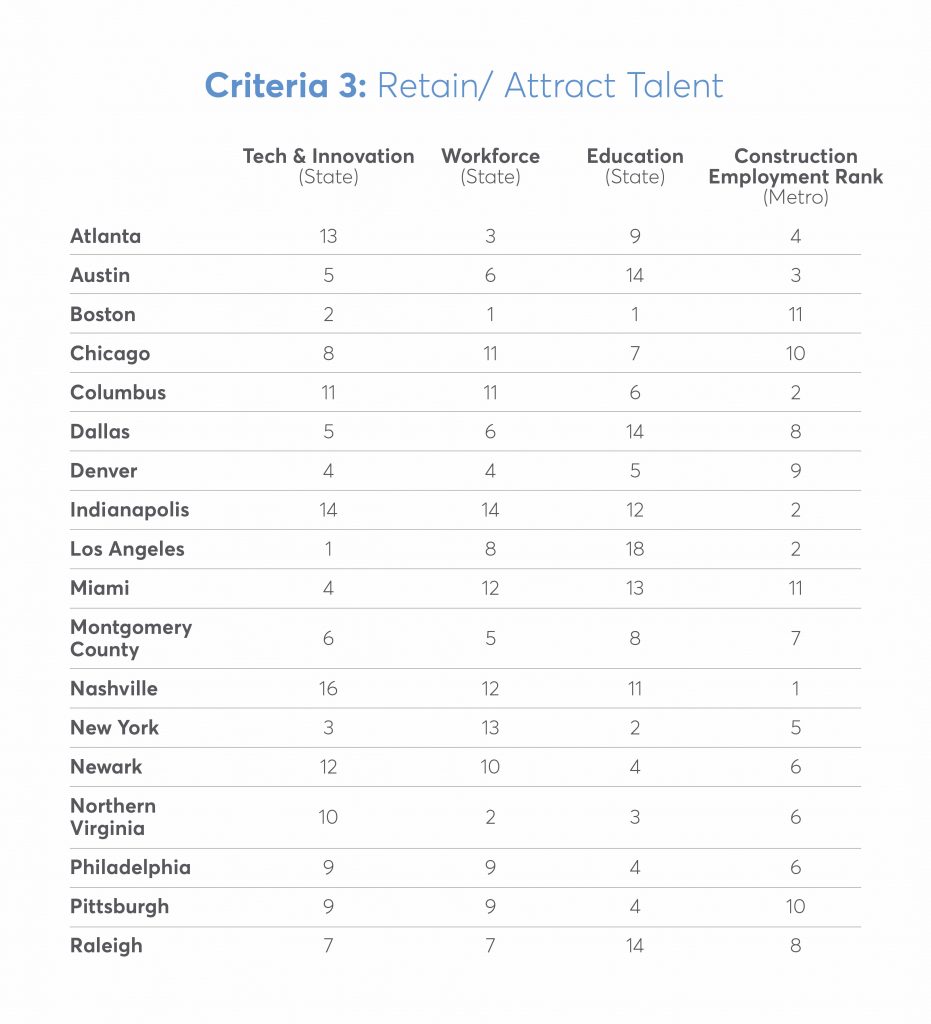

Criteria 3: Retain and Attract Talent

In order to make the cut, cities under consideration for Amazon HQ2 have to have a high level of tech and innovation already present. Cities that have invested in these fields are more likely to have the tools for faster builds, and they’re less likely to impact residents since teams more open to construction technology are likely to be more productive.

These cities also had to have ready access to skilled labor. We’ve known for a while that construction is undergoing a labor shortage, and while lean personnel doesn’t necessarily have to mean a slowdown, it does put additional strain on a project that will have a strict deadline and budget cap. The job will require a steady stream of skilled workers needs to be available in the area, which means Amazon should invest in areas with strong job markets and local governments interested in building up the skills of younger generations.

The following considerations for retaining and attracting talent were evaluated:

- Tech and innovation (state)

- Workforce (State)

- Education (state)

- Construction employment rank (metro)

The evaluation ranked the cities as so:

The Finalists

Having narrowed our candidates to 18, we ultimately ended up with the following list:

- Austin

- Northern Virginia

- Denver

- Raleigh

- Dallas

- Atlanta

- Boston

- Nashville

- Montgomery County

- Columbus

Breaking down specifically by criteria, we found that the following Austin ranked as both the overall top choice for construction and tied for the top choice for most business-friendly. Northern Virginia emerged as the top choice for real estate, infrastructure and community. Not surprisingly, Boston was the top choice for talent and innovation. Finally, Nashville also tied Austin as a top finalist for most business-friendly.

Will Amazon Agree with Us? We’ll Have to See

In the end, it’s hard to say where exactly Amazon will choose its next headquarter location. We trust them, however, to start their projects right and to do what’s best for the world as well as their company. For now, we wait eagerly for their decision.

Responses