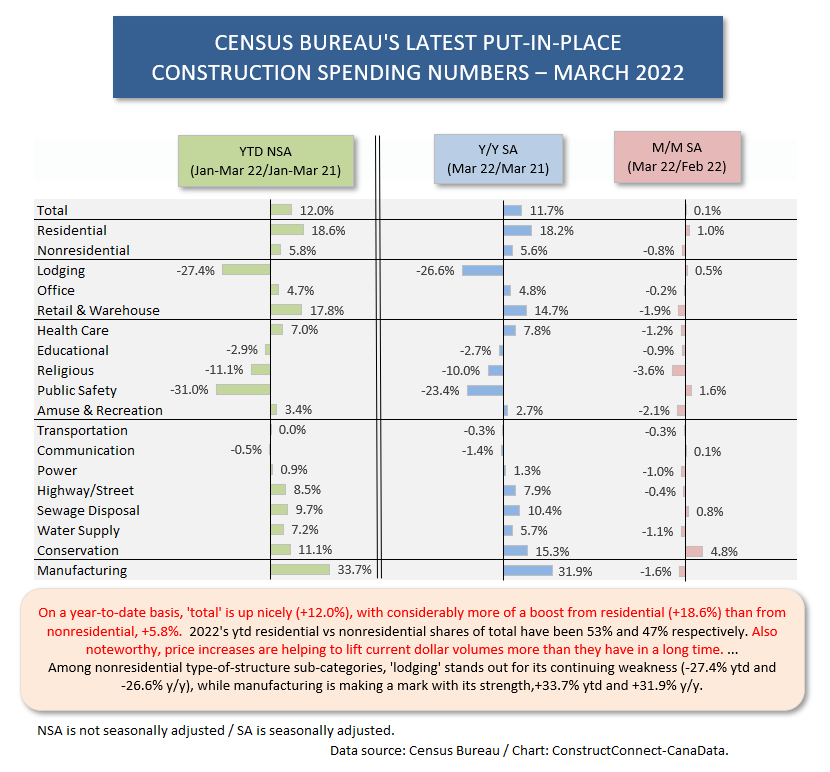

Table 1 is a one-place depiction of the key percentage-change metrics for the 2022 Q1 put-in-place construction dollar volume statistics from the Census Bureau.

Total year-to-date spending is ahead by +12.0, owing more to residential, at +18.6%, than nonresidential, +5.8%. The dollar volumes on which the percentage changes are based are in current dollars. Constant dollars would factor out inflation.

Given the exceptional advances in material input costs over the past year and some decent-sized jumps in compensation rates as well, there’s a good chance the nonresidential percentage change year-to-date (+5.8%) would be close to zero, or even possibly negative, if a price index were applied to the results.

Residential Claims Lion’s Share of Total

An astonishing switchover has occurred with respect to the shares of the total claimed by residential and nonresidential. Prior to the pandemic, the former almost always accounted for about two-fifths, or 40%, of total put-in-place construction. The latter, of course, made up the other three-fifths, or 60%.

For the first time in my memory of analyzing these stats, residential is now accounting for the lion’s share of the total, more than half, at 53%, with nonresidential at 47%, based on year-to-date not seasonally adjusted data.

The Private Versus Public Construction Story

The private versus public tugging match within total put-in-place construction is also serving up an interesting story. The former, at approximately four-fifths (82%) of 2022’s Q1 total, is +14.9% year to date; the latter, at a little less than one-fifth of the total (18.2%), is +0.7% YTD. One takeaway is that the government spending component is flat in current dollars and negative in real (inflation-adjusted) terms.

The weakness in capital spending from the public sector appears in sharp contrast with all the hype tied to the massive spending promised by the Infrastructure Investment and Jobs Act. The IIJA expenditures have been slow to materialize.

Implications of Starts as Leading Indicators for PIP

Construction starts, as calculated by ConstructConnect, lead put-in-place dollars that flow into projects at jobsites. (The PIP numbers correspond with progress or work-in-process payments.)

Therefore, it’s informative to look at where strength (or weakness) in starts is likely to impact the PIP numbers, with a time delay usually ranging from nine months to two years, depending on the type of structure and the size of individual projects.

The 2022 Q1 (versus 2021’s Q1) PIP percentage change for hotels/motels was -27.4%; but there’s encouragement for accommodation construction to be found in the 2022 Q1/2021 Q1 performance of hotel/motel starts, +31.6% YTD.

The Q1 PIP percentage change for the retail and warehouse subcategory at +17.8% was matched by a +17.0% change for retail in the starts statistics, but it did not find support from the starts results for warehouses, -39.8%. Warehouse building would be hard-pressed to maintain the frenzied pace of groundbreakings it set in 2020 and 2021.

The -2.9% Q1 PIP percentage change for educational facilities may soon receive a boost from school starts that were +11.3% from Jan-Mar 2022 versus Jan-Mar 2021.

The +8.5% Q1 PIP percentage change for ‘highways/streets’ may be just the beginning of a snowballing effect, given that road starts in Q1 were +45.9% and bridge starts, +15.1%.

Finally, in the PIP statistics, private office buildings in Q1 were +4.3% and public office buildings, +7.1%. There was no such optimism in the comparable starts statistics, where the private office percentage change was -26.0%, and the government office percentage change was also in the red, -5.1%.

Table 1

Responses