February Weighed Down by Weather & Host of Worries

ConstructConnect announced today that February 2022’s volume of construction starts, excluding residential work, was $25.7 billion, a decline of -14.3% compared with January’s figure of $30.0 billion (previously reported as $29.2 billion).

On the plus side, the latest month’s result was +16.2% versus February of last year. As for year to date, the performance of nonresidential starts has been +5.7% relative to January-February 2021.

View this information as an infographic.

Click here to download the complete Construction Industry Snapshot Package – January 2022 PDF.

In the latest month, there were no mega-sized project start-ups. (A ‘mega’ carries an estimated value of a billion dollars or more). In January, there had been one such undertaking, the South Fork wind farm for $2 billion in East Hampton, New York.

February of last year also included a giant project in New York state, but it was a 50-story-plus residential tower at One Wall Street for $1.5 billion.

Also contributing to the month-to-month decline in February was seasonality. Harsh winter weather normally takes a toll on starts.

Several other worrisome factors, though, are also restraining starts activity. Exceptional material and labor cost increases for projects being contemplated, as part of the run-up in inflation generally, are causing some owners to pause before hitting the ‘go-ahead’ button. Design and contracting teams are being asked to take another look at where cost savings might be realized.

Additionally, two other extraordinary circumstances are weighing on the project initiation decision. Interest rates are about to begin climbing again, but at what pace and to what eventual height? Also, what will be the full set of ramifications in financial, foreign trade, and other economic and social circles from the measures imposed by the United States and its allies to rebuke Russia for its attempted takeover of Ukraine?

GRAND TOTAL starts in February 2022 (i.e., including residential activity) were -13.5% m/m, but +1.9% y/y and +2.5% ytd.

Across the Board M/M Weakness

There are three major subcategories of total starts: residential, nonresidential building, and heavy engineering/civil. On a year-to-date basis in February 2022, engineering starts were strongest at +18.1%; residential starts were essentially flat, -0.9%; and nonresidential building starts walked a little behind, -3.2%.

On a month-to-month basis in February, there was nothing but slippage in the starts volumes, with engineering -22.6%; residential, -12.5%; and nonresidential building, -6.4%.

Encouraging Climb in Y/Y Trailing 12-Month Starts

Other statistics often beloved by analysts are trailing twelve-month (TTM) results and these are set out for all the various type-of-structure categories in Table 10.

Grand Total TTM starts in February 2022 on a month-to-month basis were +0.1%, which was only a bit less of an uptick than the +0.2% figures recorded in the two preceding months, January 2022, and December 2021.

On a year-over-year basis in February 2022, GT TTM starts were +9.5%, an improvement over January 2022’s figure of +8.5%. In turn, the +8.5% was a step up from December 2021’s +7.5%. It’s encouraging to see the steady gains being made in the y/y results from one month to the next.

Res-to-Nonres Relationship Stays Half-and-Half in PIP Numbers

Starts compile the total estimated dollar value and square footage of all projects on which ground is broken in any given month. They lead, by nine months to as much as two years, put-in-place (PIP) statistics which are analogous to work-in-progress payments as the building of structures proceeds to completion.

PIP numbers cover the universe of construction, new plus all manner of renovation activity, with residential traditionally making up two-fifths (about 40%) of the total and nonresidential, three-fifths (i.e., the bigger portion, at around 60%).

Over the course of the pandemic, though, the mix has undergone a profound shift. In 2021’s full-year PIP results, the residential to nonresidential relationship was approximately half and half. And that relationship, on a not seasonally adjusted (NSA) basis, was maintained in January of this year, with residential being 49.3% of the total and nonresidential, 50.7%. (Nonresidential is nonresidential buildings plus engineering).

January 2022 over January 2021 total dollar volume of PIP construction was +8.4%, with residential being +13.3% and nonresidential, +4.1%. Moving deeper into 2022, the expectation is that burgeoning nonresidential activity will eliminate the gap with a less frenetic residential.

PIP numbers, being more spread out, have smaller peak-over-trough percent-change amplitudes than the starts series. As an additional valuable service for clients and powered by its extensive starts database, ConstructConnect, in partnership with Oxford Economics, a world-leader in econometric modeling, has developed put-in-place construction statistics by types of structure for U.S. states, cities, and counties, actuals, and forecasts. ConstructConnect’s PIP numbers are being released quarterly and are featured in a separate reporting system.

Nice Y/Y Gains in Construction-Related Employment

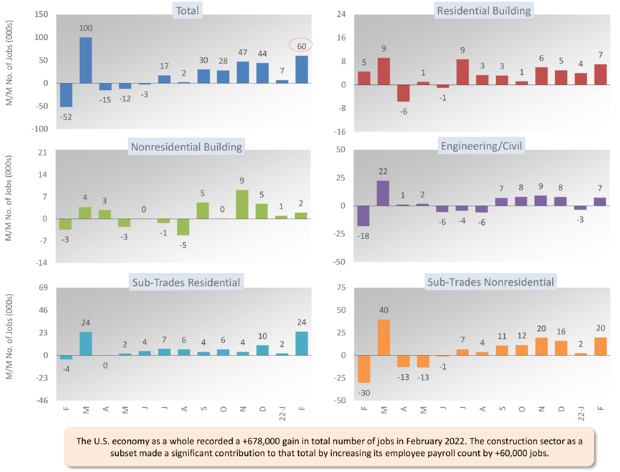

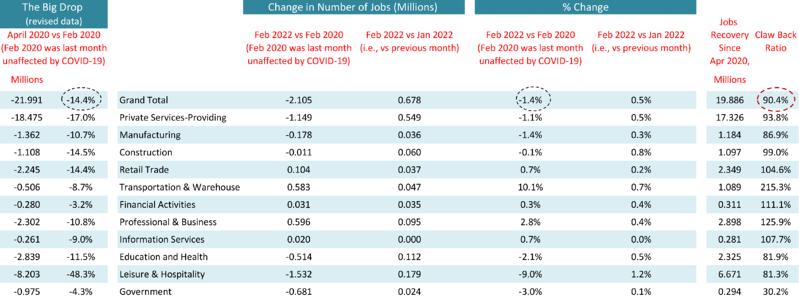

In January 2022, the U.S. total jobs count rose by +481,000, but the construction sector as a subset increased staffing by only +7,000. In February, economy-wide employment rose by +678,000 jobs, with construction making a significant contribution, +60,000 jobs. More than two-thirds of the +60,000 gain came among the specialty trades, with residential subcontractors at +24,000 and nonresidential at +20,000.

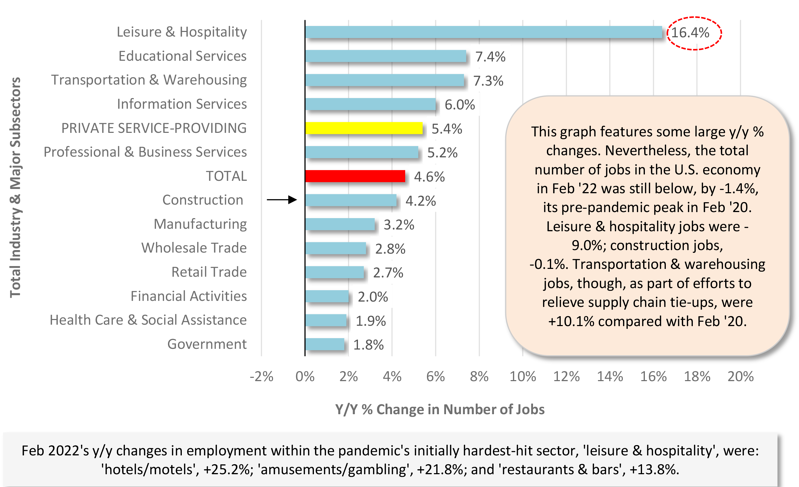

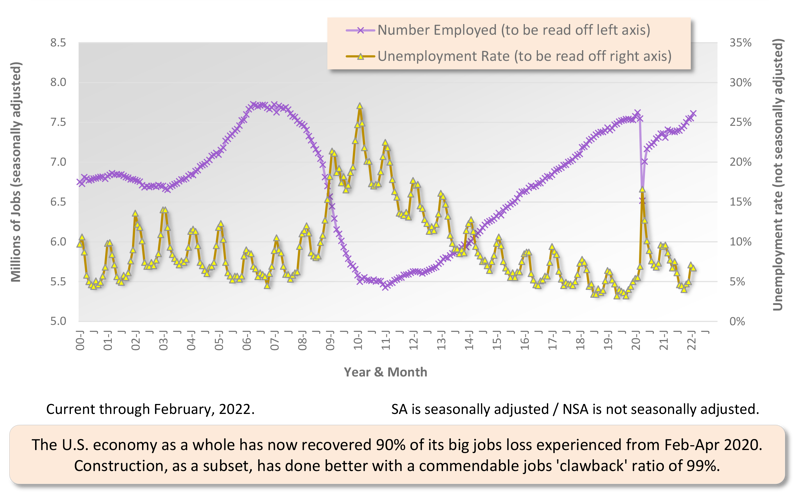

IThe jobs recovery ratio economy-wide (i.e., versus the big plummet in employment between February and April 2020, when the coronavirus first struck) has improved to 90.4%. Construction’s jobs claw-back ratio is even better, though, at 99.0%.

The national NSA unemployment rate is presently 4.1%. The construction sector’s latest (February 2022) NSA U rate is 6.7%, but that’s better than the prior month’s 7.1%, and it’s tighter than February 2021’s level of 9.6%.

Year-over-year total employment in the U.S. is now +4.6%, with construction not far behind at +4.2%. The most recent y/y jobs gains in other corners of the economy with close ties to the building sector have been: +13.5% for oil and gas extraction; +9.3% for machinery and equipment rental; +6.1% for architectural and engineering services; +4.6% for both real estate firms and cement and concrete product manufacturing; and -2.3% for building material and supplies dealers.

By the way, total sales by U.S. building material and supplies dealers in January were a sprightly +10.9% year over year. A significant portion of that big jump, though, was due to price increases (i.e., think global oil at $100-plus USD/barrel and its impact on gasoline). For the first time in many years, assessing the difference between ‘current’ and ‘constant’ (inflation-adjusted) dollars has become important again. America’s all-items Consumer Price Index is +7.9% y/y. The 2022 construction price index deflator being adopted by Oxford Economics is +10.1% y/y.

Graph 1: Change in Level of U.S. Construction Employment, Month to Month (M/M) −

Total & by Categories – October 2021

Graph 2: U.S. Employment February 2021 – % Change Y/Y

Based on Seasonally Adjusted (SA) Data

Graph 3: Y/Y Jobs Change, U.S. Total Industry & Major Subsectors — February 2022 (Based on Seasonally Adjusted Payroll Data)

Graph 4: U.S. Construction Employment (SA) & Unemployment Rate (NSA)

Table 1: Monitoring the U.S. Employment Recovery — February 2022

Pluses and Minuses Among the Type of Structure Subcategories

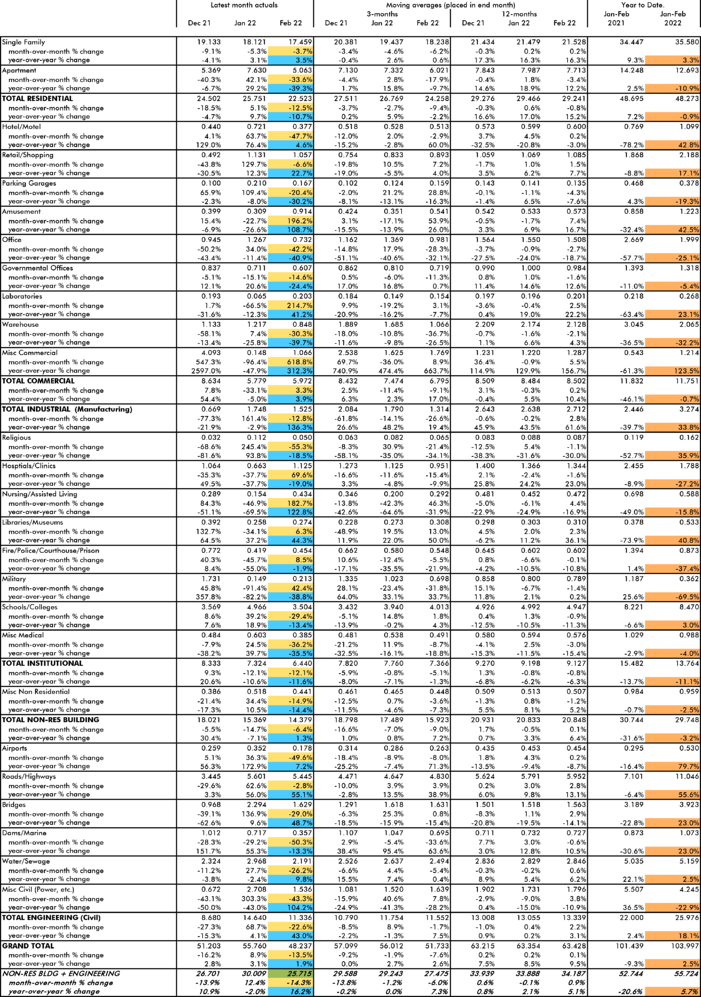

February 2022’s -14.3% month-to-month (m/m) drop in total nonresidential starts was due to contractions in engineering (-22.6%), industrial (-12.8%) and institutional (-12.1%), while commercial managed a mild uptick, +3.3%.

The +16.2% performance of total nonresidential starts in February of this year versus February of last year (y/y) resulted from big leaps in industrial (+136.3%) and engineering (+43.0%), and a less-showy pickup in commercial (+3.9%). Institutional (-11.6%) failed to make headway.

As for February’s year-to-date advance of total nonresidential starts (+5.7%), industrial (+33.8%) and engineering (+18.1%) were the ringleaders, while commercial (-0.7%) stayed neutral and institutional (-11.1%) faded into the background.

There are two dominant subcategories of total nonresidential starts. When the volumes of roads/highways and schools/colleges are added together, they accounted for more than one-third of total year-to-date nonresidential activity in February 2022 (i.e., shares of 19.8% and 15.2% respectively, summing to 35.0%).

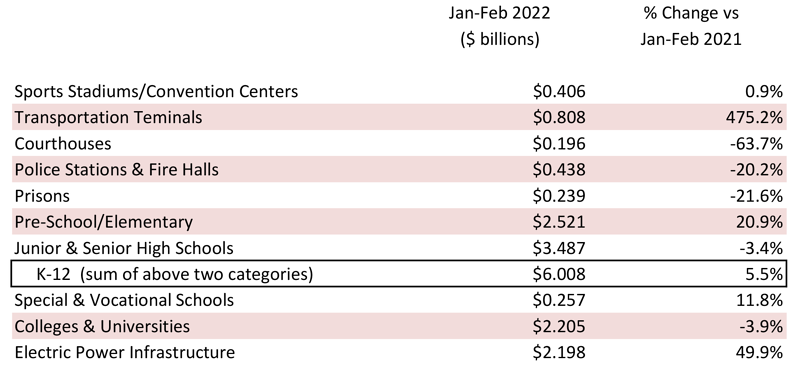

The three percentage-change metrics for street starts in February 2022 were -2.8% m/m, but +55.1% y/y and +55.6% ytd. For school starts, the results were -29.4% m/m and -13.4% y/y, but +3.0% ytd. Delving deeper into educational facility starts, the subcategory ‘pre-school and elementary’ was the standout year to date, +20.9%.

Accounting for a fifth of engineering starts so far this year, the ‘water/sewage’ subcategory in February was -26.2% m/m, but +9.8% y/y and +2.5% ytd.

Bridge work, along with many other types of engineering activity, is eagerly awaiting spending to flow from the Infrastructure and Investment Jobs Act (IIJA). In the latest month, bridge starts were -29.0% m/m, but +48.7% y/y and +23.0% ytd.

For the three medical subcategories combined, i.e., hospital/clinic, nursing/assisted living, and miscellaneous medical, February 2022’s starts were better m/m (+36.9%), but worse both y/y (-10.9%) and ytd (-19.5%). Hospital/clinic starts alone were +69.6% m/m, but -19.0% y/y and -27.2% ytd.

Among commercial starts in February, there were notable gains (+618.8% m/m; +312.3% y/y/ and +123.5% ytd) for the miscellaneous subcategory, which includes sports stadiums and transportation terminals. Also on the upswing year to date were hotels/motels, +42.8%, and retail/shopping, +17.1%. Moving downward ytd, though, were private and government office buildings, -25.1% and -5.4% respectively.

Warehouse starts have not had a stellar beginning to 2022, turning in a record in February that was -30.3% m/m, -39.7% y/y, and -32.2% ytd.

Table 2: Construction Starts in Some Additional Type of Structure Subcategories

Latest JOLTS Numbers Offer No Hiring Woe Relief

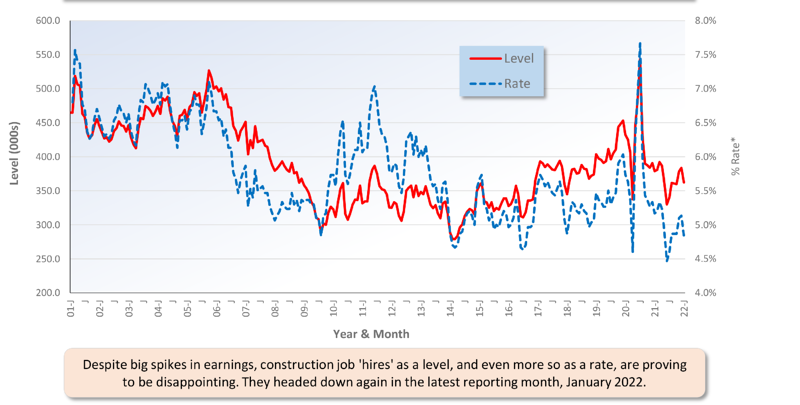

For ease of viewing, Graphs 5 and 6 show smoothed curves (i.e., based on three-month moving averages) for the Job Openings and Labor Turnover Survey (JOLTS) results pertaining to vacant positions and hires.

Openings in the construction industry remain extremely elevated. Both as a level and a rate, they are near their all-time peaks. But that’s not translating to much in the way of ‘hires’, according to the JOLTS numbers. Not only have hires as a level and rate been low recently, relative to earlier this century, but they also have the unfortunate habit of following an uptick with a dip.

Graph 5: U.S. Construction Job Openings (from JOLTS Report)

(3-month Moving Averages placed in Latest Month)

Graph 6: U.S. Construction Job Hires (from JOLTS Report)

(3-month Moving Averages placed in Latest Month)

Trend Graphs Pondering Where to Turn

This Industry Snapshot showcases a dozen type-of-structure trend graphs. The trends are captured by taking 12-month moving averages of ConstructConnect’s starts statistics.

Most of the curves have flattened out, although it’s good to see nonresidential construction moving upwards once again, albeit cautiously. Also, it’s interesting that commercial and institutional have, for the past half dozen years, achieved quite similar dollar volumes.

Among subcategories, only two are showing truly distinct patterns. The private office construction slope is still headed south; the curve for roads/highways remains northbound.

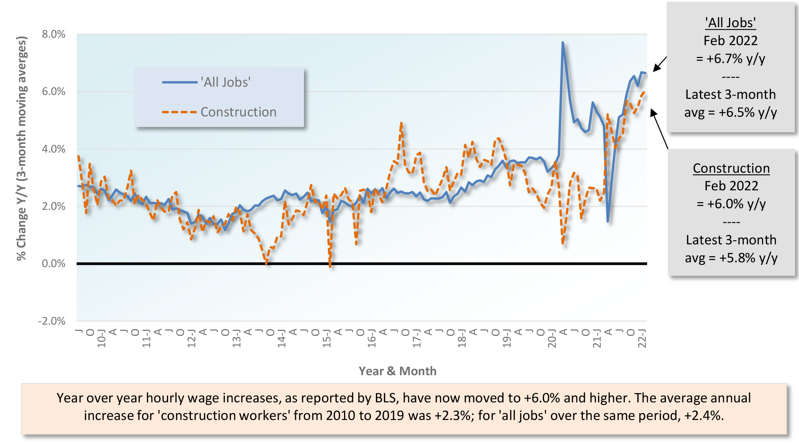

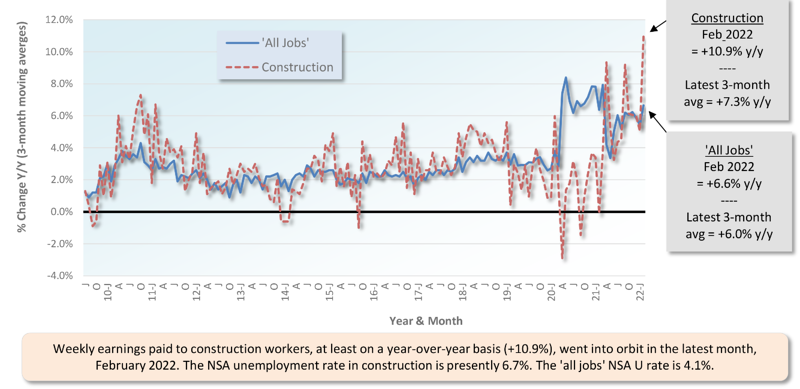

Hourly and Weekly Earnings Roared in February

Tables B-3 and B-8 of the monthly Employment Situation report, from the BLS, record average hourly and average weekly wages for industry sectors. B-3 is for all employees (i.e., including bosses) on nonfarm payrolls. B-8 is for production and nonsupervisory personnel only (i.e., it excludes bosses). For all jobs and construction, there are eight relevant percentage changes to consider.

From February 2022’s Table B-3 (including bosses), all jobs earnings were +5.1% hourly and +5.4% weekly. Construction workers kept pace and then some, earning the same +5.1% hourly, but receiving an even better +8.1% weekly. From Table B-8 for production and non-supervisory workers (i.e., excluding bosses), the all jobs compensation gains were +6.7% hourly and +6.6% weekly. Where construction workers lagged a little hourly, +6.0%, they more than made up the difference weekly, +10.9%.

Graph 7: Average Hourly Earnings Y/Y – All Jobs & Construction

Graph 8: Average Weekly Earnings Y/Y – All Jobs & Construction

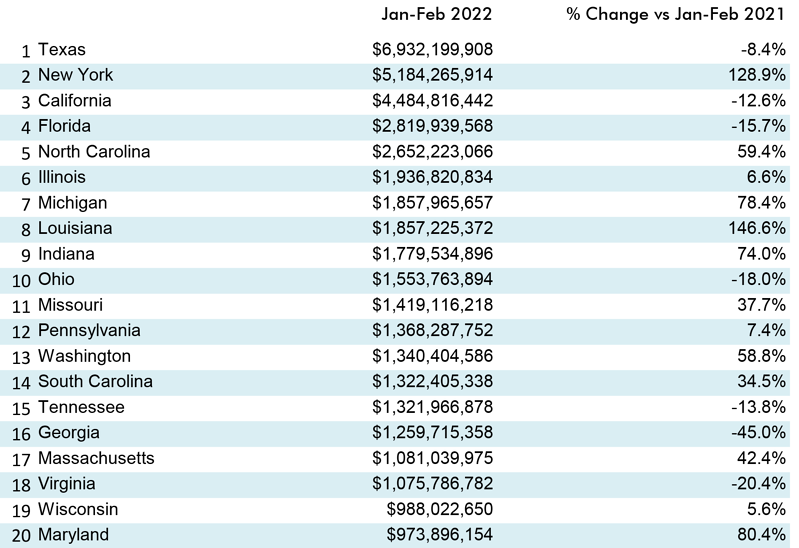

Table 3: 2022 YTD Ranking of Top 20 States by $ Volume of Nonresidential Construction Starts — ConstructConnect®

Table 4: 2022 YTD Ranking of Top 20 States by $ Volume of Nonresidential Building Construction Starts — ConstructConnect®

Table 5: 2022 YTD Ranking of Top 20 States by $ Volume of Heavy Engineering/Civil Construction Starts — ConstructConnect®

Input Costs and Bid Prices on a Tear

February’s y/y results for three building-related BLS Producer Price Index (PPI) series were as follows: (A) construction materials special index, +28.7% (markedly down from January’s +34.4%); (B) inputs to new construction index, excluding capital investment, labor, and imports, +20.5% (a smidge up from the previous month’s +19.7%); and (C) final demand construction, designed to capture bid prices, +16.6% (an advance from January’s +16.0%).

(A) comes from a data series with a long history, but it’s confined to a limited number of major construction materials. (B) has a shorter history, but it’s more comprehensive in its coverage, although it includes some items (e.g., transportation) that aren’t strictly materials.

Concerning the cost of some major construction material inputs, as revealed in the PPI data set published by the BLS, diesel fuel is +57.5% y/y; hot rolled steel bars, plates, and structural shapes, +45.6%; aluminum sheet and strip, +37.7%; asphalt, +37.5%; softwood lumber, +22.2%; gypsum, +20.7%; copper wire and cable, +15.6%; ready-mix concrete, +8.2%; and cement, +7.6%.

The value of construction starts each month is derived from ConstructConnect’s database of all active construction projects in the United States. Missing project values are estimated with the help of RSMeans’ building cost models. ConstructConnect’s nonresidential construction starts series, because it is comprised of total-value estimates for individual projects, some of which are super-large, has a history of being more volatile than many other leading indicators for the economy.

February 2022’s ‘Grand Total’ Starts +2.5% YTD

ConstructConnect’s total residential starts in February 2022 were -12.5% m/m, -10.7% y/y and -0.9% ytd. Multi-family starts in February were -33.6% m/m, -39.3% y/y and -10.9% ytd. Single-family starts were -3.7% m/m, but +3.5% y/y and +3.3% ytd.

Including home building with all nonresidential categories, Grand Total starts in February 2022 were -13.5% m/m, although +1.9% y/y and +2.5% ytd.

ConstructConnect adopts a research-assigned ‘start’ date. In concept, a start is equivalent to ground being broken for a project to proceed. If work is abandoned or rebid, the start date is revised to reflect the new information.

Expansion Index Monitors Construction Prospects

The economy may be in recovery mode, but nonresidential work is usually a lagging player. Companies are hesitant to undertake capital spending until their personnel needs are rapidly expanding and their office square footage or plant footprints are straining capacity. Also, it helps if profits are abundant. (Today’s greater tendency to work from home has made office occupancy much more difficult to assess.)

Each month, ConstructConnect publishes information on upcoming construction projects at its Expansion Index.

The Expansion Index, for hundreds of cities in the United States and Canada, calculates the ratio, based on dollar volume, of projects in the planning stage, at present, divided by the comparable figure a year ago. The ratio moves above 1.0 when there is currently a larger dollar volume of construction ‘prospects’ than there was last year at the same time. The ratio sinks below 1.0 when the opposite is the case. The results are set out in interactive maps for both countries.

Click here to download the Construction Industry Snapshot Package – February 2022 PDF.

Click here for the Top 10 Project Starts in the U.S. – January 2022.

Click here for the Nonresidential Construction Starts Trend Graphs – February 2022.

Table 6: Value of United States Nonresidential Construction Starts February 2022 – ConstrucConnect

*Includes transportation terminals and sports arenas.

Source: ConstructConnect Research Group and ConstructConnect.

Table: ConstructConnect.

Table 7: Value of United States Construction Starts

ConstructConnect Insight Version – February 2022

Arranged to match the alphabetical category drop-down menus in Insight

Table 2 conforms to the type-of-structure ordering adopted by many firms and organizations in the industry. Specifically, it breaks nonresidential building into ICI work (i.e., industrial, commercial, and institutional), since each has its own set of economic and demographic drivers. Table 3 presents an alternative, perhaps more user-friendly and intuitive type-of-structure ordering that matches how the data appears in ConstructConnect Insight.

Source: ConstructConnect.

Table: ConstructConnect.

Table 8: Value of United States National Construction Starts – February 2022 – ConstructConnect

Billions of current $s, not seasonally adjusted (NSA)

Data Source and Table: ConstructConnect.

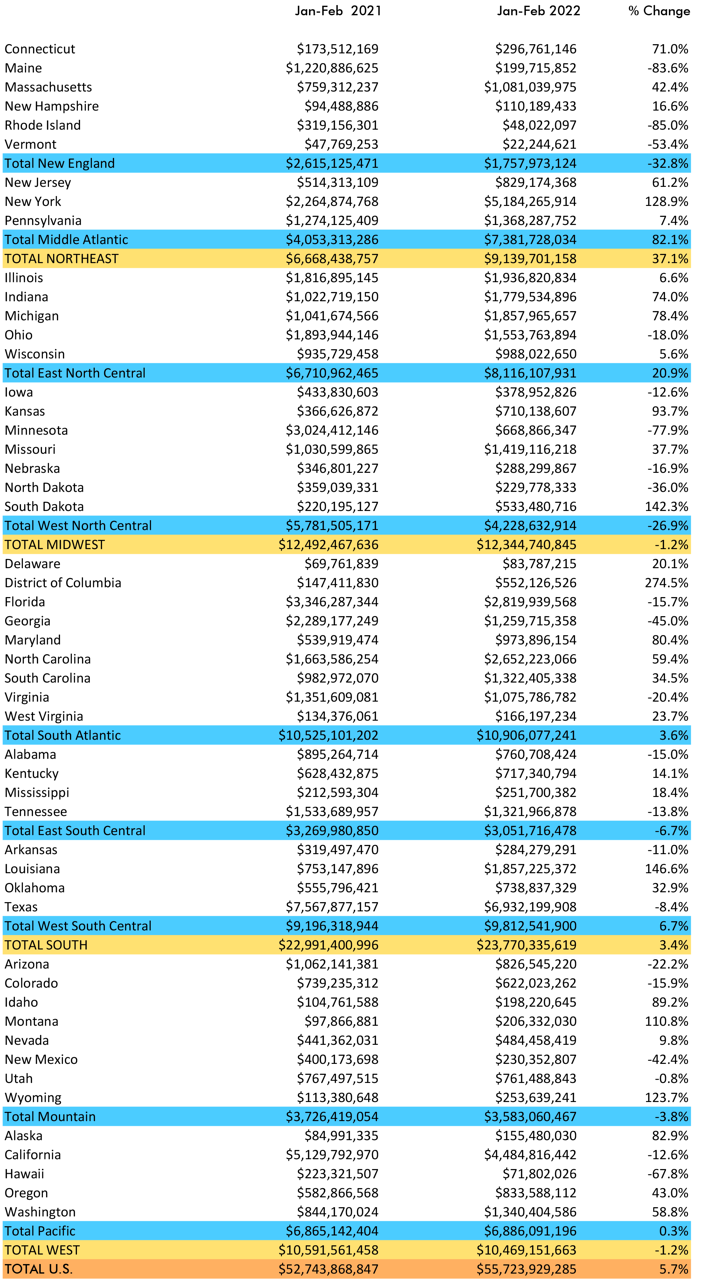

Table 9: U.S. YTD Regional Starts

Nonresidential Construction* — ConstructConnect

*Figures above are comprised of nonres building and engineering (i.e., residential is omitted).

Data Source and Table: ConstructConnect.

Responses