2022 has been a mixed bag for the U.S. construction industry.

This past year brought skyrocketing inflation and interest rates, but contractors remained optimistic despite the rocky economic conditions.

Inflation was a major concern in 2022, climbing to a 40-year high in June. It was fueled by ongoing supply chain snarls brought on by pandemic stresses as well as Russia’s invasion of Ukraine. As a result, prices jumped on key construction materials such as cement, diesel and asphalt. The industry also continued to struggle to attract enough workers in an overall tight labor market.

On a more positive note, backlog remained strong — although that metric went negative in October for the first time in more than a year.

As the new year approaches, the big question on construction leaders’ minds is what’s in store for 2023. Top construction economists say much like in 2022, signals are mixed.

Here is a look at five key indicators and what they suggest for contractors in the year ahead.

Architecture billings positive streak ends

The Architecture Billings Index by AIA. A score above 50 indicates positive growth.

When architects are busy, contractors likely are, too. The Architecture Billing Index from the American Institute of Architects is an indicator of future nonresidential construction spending nine to 12 months down the line. Numbers above 50 on the ABI indicate an increase in billings.

The ABI had positive growth in 2022 until October, when it took a sharp downward turn. That could indicate that recession fears and inflation have finally started to manifest in the industry, and may translate to a drop in available construction work in the latter end of next year.

Nonetheless, Associated Builders and Contractors Chief Economist Anirban Basu said the industry lag means construction will likely stay strong in the coming year regardless of economic conditions.

“For many contractors, 2023 does not stand to be the problematic year, it’s more likely to be in 2024 or 2025 if in fact the economy enters recession in 2023,” Basu said.

Construction backlog remains steady

ABC’s member survey results measure the number of months of construction backlog.

New projects are a bellwether for contractor confidence. The industry’s backlog has remained positive over the past year — until October, that is, when the backlog declined slightly from the previous month. It’s nonetheless 0.7 higher than the year-ago period.

Backlog in the commercial and institutional category posted its largest monthly decline in October since July 2020, although infrastructure and heavy industrial projects still posted growth. The latter sectors are likely to remain bright spots in the coming years as federal funding is pumped into those sectors, according to Ken Simonson, chief economist at Associated General Contractors of America.

“I expect a big pickup in 2023 in infrastructure investment as money from the IIJA starts to be awarded and contractors get to work on those projects,” Simonson told Construction Dive. “Also continuing pickup in manufacturing construction, especially for semiconductor manufacturing plants; electric vehicle, battery, components, and battery charging manufacturing plants; and the beginning of alternative energy projects funded by tax credits and other incentives included in the Inflation Reduction Act.”

Material prices

| Material | Volatility | Price index YOY % change | Lead times | |

|---|---|---|---|---|

| Flat glass | Low | 8.2% | Increased | |

| Lumber and plywood | Low | -26.9% | Stabilizing | |

| Aluminum mill shapes | Low | 20.3% | Increased | |

| Insulation materials | Low | 16.0% | Increased | |

| Plastic construction products | Moderate | 27.0% | Increased | |

| Steel mill products | Moderate | 22.4% | Stabilizing | |

| Concrete products | Moderate | 13.5% | Increased | |

| Gypsum products | High | 18.9% | Increased | |

| #2 diesel fuel | High | 111.1% | N/A | |

| Copper and brass mill shapes | High | 0% | Increased |

Inflation has plagued the industry and COVID-19 has continued to impact supply chains, causing materials prices to swing wildly. While lumber and plywood prices were a huge concern at the beginning of the year, that has since eased and cement and diesel costs are now giving contractors grief. That volatility makes it difficult for contractors to plan projects, and it has not been uniform across construction materials.

Simonson expects price hikes and shortages to ease for some products, and to remain volatile for others.

“Cement and concrete products are likely to have continuing shortages as the nation has not added any cement production since 2009 while demand is growing, particularly from infrastructure projects,” Simonson said.

Labor

Construction employment has continued to rise in the past year.

Construction has increasingly struggled to attract enough workers, and upcoming federal spending promises to only strengthen demand. The multiple-year-long federal investment may also help workers view construction as a stable long-term career prospect and encourage them to get into the industry, Basu said.

Labor has been an ongoing challenge in the past year, and while Bureau of Labor Statistics data showed more construction jobs were filled and fewer workers quit in October, the number of open jobs ticked back up in November.

As the overall jobs market shows signs of weakening, the industry may be able to benefit from more people seeking work. Still, upcoming federal spending promises to keep demand for construction workers high. Simonson expects labor availability to remain the top challenge for most contractors, with high job opening rates and rising wages continuing into the new year.

Value of projects

Optional Caption

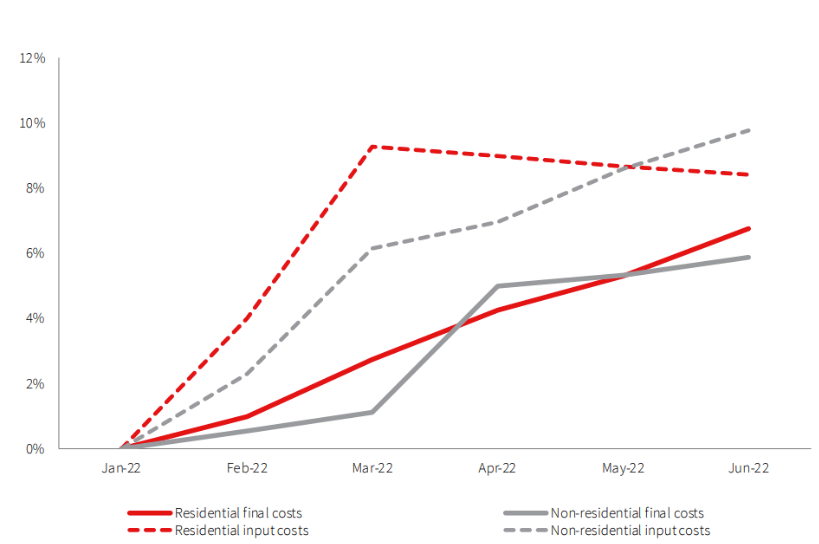

Inflation, high wages and other price increases have cut into contractors’ bottom lines in 2022. In the past year input costs — that is, the prices of materials, labor and other project expenses — have not kept up with final costs of a project, or the amount billed to the owner. However, both indicators are trending in a positive direction for contractors.

The coming year will probably bring selective reductions in materials costs and supply chain bottlenecks, Simonson said, but despite some easing for builders, he still expects that construction input costs are likely to continue rising more than overall consumer prices. Happily for contractors, as bid prices tick up, that indicates owners are willing to pay more.

Though contractors’ profits are squeezed, they should be able to make projects pencil out, according to JLL.

“Though the input-bid spread will eventually be covered, recessionary fears are likely to slow the rate at which costs are passed on,” according to JLL’s 2022 H2 Outlook report. “However, the long duration of many projects — especially larger infrastructure and similar funded by the IIJA — are likely to provide sufficient opportunities for the market to maintain heightened activity levels even with more narrow margins.

Responses